Differentiated Natural Gas: Cutting Emissions from Source to Supply

Uncovering the hidden climate and financial costs behind natural gas sourcing decisions.

Looking at the greenhouse gases emissions over the life cycle of natural gas, its origin can represent up to 15% of its total CO2 footprint and nearly 85% of methane emissions.

In the complex world of energy procurement and supply chains, understanding the origins of natural gas can have a significant impact on the emission footprint, financial ROI and risks exposure of a company.

The high variability of GHGs upstream impacts underscores the importance of a deeper consideration of upstream emissions into investments and procurement decisions as the latest IEA study shows correlation between emission abatement investments and higher annual ROI.

Regulatory landscape, particularly EU's methane regulations, US's proposed methane fee and enhanced monitoring requirements, and South Korea's strengthened methane reduction objectives, create both compliance costs and financial risks that amplify the business case for proactive procurement decisions.

Taking natural gas emissions into consideration is not just environmentally responsible but also economically prudent.

IEA studies shows:

- “Methane abatement often comes at little or even negative cost"

- Reducing flaring and methane emissions in oil and natural gas suppliers could make more than 80 bcm of additional gas available to the EU

- Almost all the available methane abatement measures across the energy sector would be cost-effective to deploy in the presence of a greenhouse gas emissions price of about USD 20/tCO2-eq”

Production & Transport method: key markers of emissions differentiation in natural gas & LNG supply

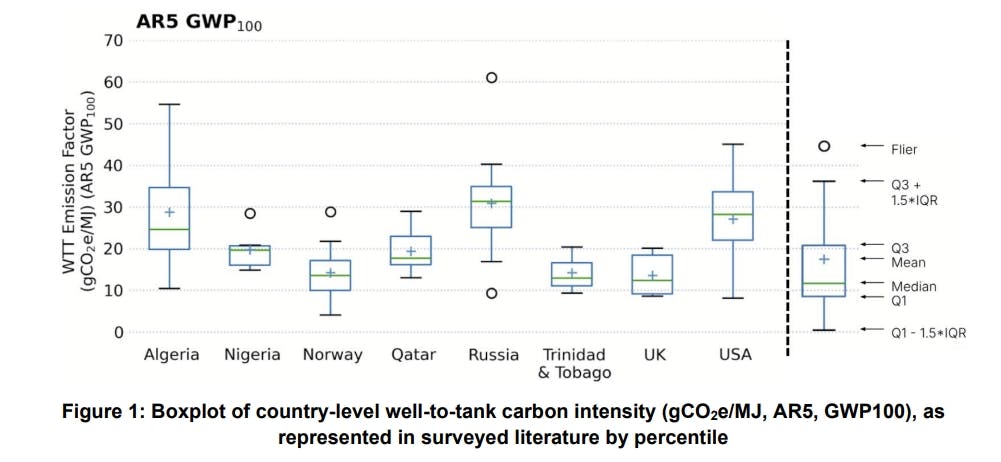

Because natural gas can come from various sources (coal bed methane wells or shale gas wells for example), different extraction methods have emerged and for each, the CO2 impact and the methane emissions vary. For instance, hydraulic fracturing has higher potential to release methane into the atmosphere during the extraction process while conventional drilling may result in other environmental impacts, such as habitat destruction and groundwater contamination. Furthermore, regions with outdated infrastructure or less stringent regulations may experience higher rates of flaring, venting, and other controlled or uncontrolled releases. These emissions can result from:

-Planned releases: design-related venting, operational requirements for pipeline maintenance or safety systems,

-Unplanned leaks: defective valves, faulty seals, or incomplete combustion (e.g., inefficient flaring).

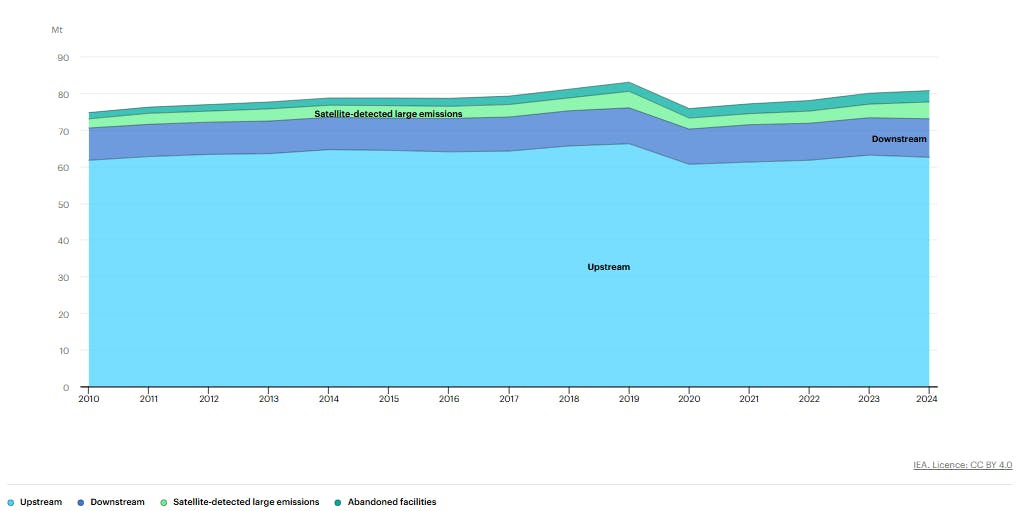

Globally, IEA estimates an average methane leakage in upstream natural gas at around 1,6% but there is a wide variation among sources: the best performers have an emissions intensity that is more than 100 times lower than the worst performers.

Transportation methods and distance should also be considered when looking at the gas GHG impact. Gas pipelines and LNG tankers do not account for the same level of emissions. In most cases, gas pipelines transportation emits less than LNG tankers mainly because the transformation process of gas to LNG is twice as important in terms of energy intensity and in terms of emissions compared to gas pipeline transport.

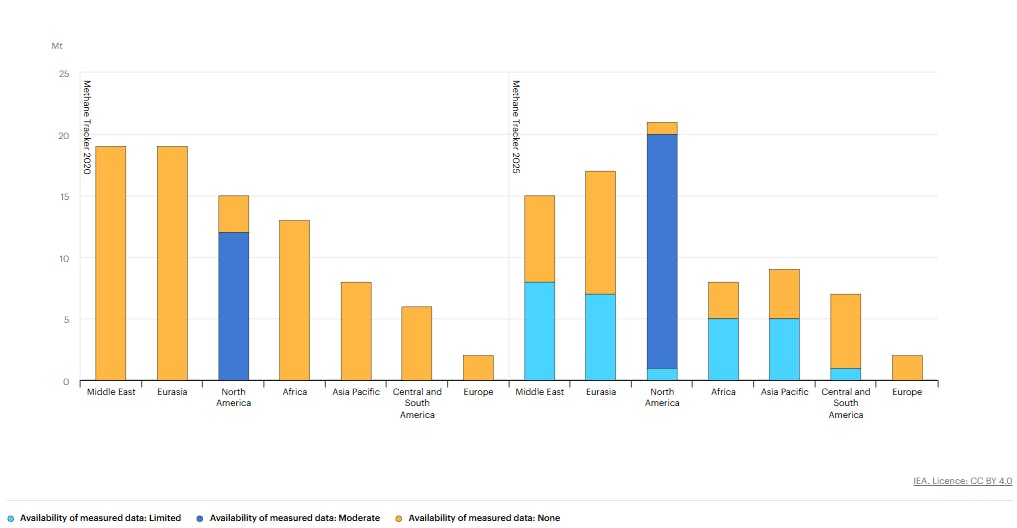

However, one must account for leakage level of the pipeline networks and the distance travelled for gas to be delivered. From extraction, processing and transport, the broad range of emissions can vary by more than five-fold across different geographies. Energy buyers must increasingly consider these factors to make informed, climate-conscious decisions.

Economic opportunities through methane reductions

While some reduction methods require significant initial investment and new infrastructure to transport gas to market, methane reduction in natural gas operations presents a major financial opportunity. According to the latest IEA report (2025), approximately 30% of current industry methane emissions could be cut using techniques that deliver over 25% of annual returns, well above what oil and gas companies typically expect from new investments, with many measures paying for themselves within just one year.

However, several barriers prevent companies from seizing these profitable opportunities. These include lack of awareness about emission levels, available solutions, and actual costs decision competition from other high-profile investments. Furthermore, equipment owners may not directly benefit from leak reductions or contracts might not link methane savings to revenue.

As regulatory frameworks tighten, particularly in the EU where fossil energy-related CH4 and CO2 emissions face increasingly stringent monitoring, companies are experiencing pressure and urgency to minimize emissions intensity across their value chain.

EU Regulatory framework

As one of the world's largest natural gas importers, the EU is working to reduce and prevent emissions and raise the level of environmental accountability.

To this purpose, the EU has established since August 4, 2024, an EU-wide Methane Emissions Reduction Regulation implementing gradual obligations on fossil fuel importers, including natural gas, oil, and coal, to report production-related methane emissions intensity.

However, while CO₂ and methane monitoring have improved in recent years through the deployment of satellite-based detection systems, installation of continuous monitoring equipment at production facilities, implementation of standardized measurement protocols and local regulations, the IEA highlights that methane emissions remain globally underreported. In Australia, for the oil and gas sector, IEA’s estimates are 92% higher than the national inventory data.

The EU Methane Regulation provides a robust starting framework, but further harmonization is expected. Given these evolving market and regulatory dynamics, how can natural gas exporters position themselves to capitalize on methane reduction opportunities while ensuring compliance?

Practical considerations for natural gas buyers

As companies work to cut emissions and meet compliance requirements, for natural gas procurement teams, integrating origin-based emissions data into decision-making processes is increasingly essential. Buyers should prioritize suppliers that provide transparent, audited emissions data across their operations including, for example, upstream methane leakage rates or transportation carbon intensity. This integration can be aligned with voluntary corporate strategic ESG commitments and/or compliance constraints while maintaining security of supply.

Procurement contracts may also include emissions performance clauses or favor suppliers from regions with robust regulations and monitoring systems. As regulatory pressure and stakeholders’ expectations grow, energy buyers who proactively account for upstream impacts will be better equipped to meet compliance requirements, avoid reputational risks, and establish themselves as climate leaders in their industries.

A flexible, interoperable registry solution, such as Attributes™ platform, is essential to support global acceptance, manage and trace the influx of emission data calls and avoid double counting.

Attributes™, a concrete solution for gas LNG tracking

Specialized in natural gas and LNG traceability solutions, Attributes™ solution offers a secure and flexible approach to track value chain emissions from producers to consumers.

- Independent, Open, Standard-agnostic

Attributes™ can adapt to specific local emissions standard, or company-own frameworks

- A secure blockchain-based platform for differentiation and risk mitigation

Enhance trust with differentiated supply, avoid greenwashing and regulatory penalties

- Proven Technology